Is DeFi Finally the Real Deal?

Is DeFi Finally the Real Deal?

For years, the crypto world has been heads down: building protocols, debating tokenomics, chasing scalability. All this while one big question loomed: Have we built anything truly useful yet?

While many of us in the space already believe the financial system is quietly being rewritten. It might not be the Crypto vs TradFi story originally told by the media but more a merging of the two worlds and while large enterprises put infrastructure and rails in place to enable this, it has taken a while for some key players to really back it.

Vitalik Buterin finally answered that question. He’s long held an almost impossibly high bar for what counts as success in crypto and until recently, most financial apps on Ethereum didn’t make the cut. Now they do! Low risk DeFi is Ethereum’s killer use case. Not just because it’s clever, but because core financial tools on Ethereum have become useful and, crucially, safe enough.

What “Passing the Test” Looks Like

Vitalik’s benchmark for success isn’t about hype or speculation. It’s about meaningful impact: improving lives at scale and reducing risk.

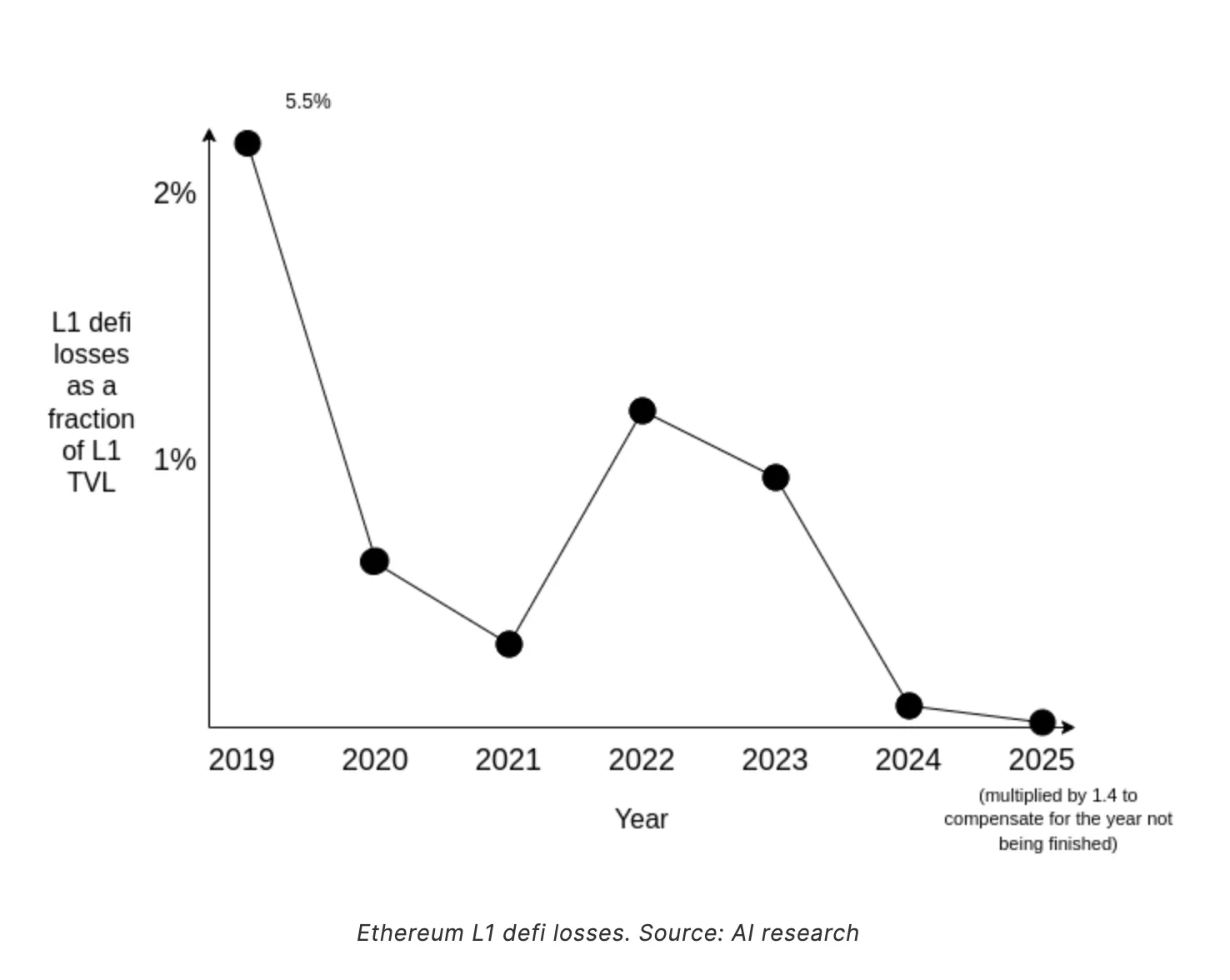

That last piece “risk” is where the biggest shift has happened. Early DeFi was chaotic: exploits, rug pulls, cascading volatility. But the ecosystem learned. Contracts hardened, audits became standard, and protocols matured. The result? Risk has genuinely decreased. For people in fragile traditional banking systems, DeFi has evolved into a safer alternative.

Which tools have cleared the bar on Ethereum Layer-1? Storing value, swapping or exchanging, earning yield, borrowing against collateral, and issuing new assets.

These aren’t speculative toys anymore. They’re foundational. And together they unlock global, democratised access to payments and savings. Where high quality banking was once geographically privileged, now anyone with an internet connection can access these services through DeFi.

DeFi as Google, Ethereum as the Internet of Value

Vitalik draws a strong analogy: Ethereum is the Internet of Value; DeFi is its Google. This shift is about making finance usable for everyone—not just early adopters.

Here’s what that brings:

- ETH becomes more important: It’s collateral and settlement currency for a global financial layer.

- Decentralisation holds: Low risk protocols resist the centralising pull of high frequency trading.

- Scalability follows: Liquid, composable primitives can scale toward trillions in value.

Prediction markets are an especially interesting frontier. As they mature, they’ll plug into this base, enabling better hedging and global risk sharing tools.

Institutional Doors Are Opening

One of the strongest signals that DeFi is entering a new phase isn’t just coming from developers. It’s coming from regulators and institutions.

In the UK, the government recently ruled that investors will be able to hold crypto exchange traded notes (ETNs) within tax incentivised accounts like ISAs and pensions. The FCA simultaneously lifted its ban on retail access to crypto ETNs, with trading expected to open up shortly.

This is a big deal. It moves crypto exposure from the fringes to tax-efficient mainstream savings vehicles. While there are some quirks, like the requirement to buy during the current tax year for ISAs, this represents a clear regulatory green light for more structured, long-term crypto adoption in a major financial market.

Meanwhile, on the infrastructure side, Swift and Chainlink have been collaborating through the Cross-Chain Interoperability Protocol (CCIP) to connect traditional financial systems with multiple blockchains. This means banks and market participants can interact with tokenised assets and DeFi protocols through familiar Swift infrastructure, a Swift-compatible protocol so institutions don’t need to migrate, or create specialised integrations. Underneath, this uses CCIP to handle secure messaging and settlement across chains.

This is more than a proof of concept, it’s been in the works for many years and is a mature system that will be a bridge between trillions in traditional finance and the rapidly maturing DeFi base layer.

The Roadmap for Eth Is Falling Into Place

| Component | Role |

|---|---|

| ETH | Settlement collateral — a world reserve asset |

| DeFi (on L1) | Global banking layer |

| Ethereum L1 | Ledger for slow, high-value, trust-sensitive DeFi |

| Ethereum L2s | Ledgers for fast, high-frequency activity |

Other chains claim to be “faster,” but many are really competing to be better L2s not the settlement layer. And if you had to disappear for a decade and leave your assets somewhere, realistically your choices narrow to Bitcoin or Ethereum. Out of the two, only Ethereum gives you native low risk financial infrastructure and programmable contracts to build on, with a staking layer that is lower risk.

Why This Matters

When Vitalik asks “Have we earned it?” he’s answering yes. The pieces are locking in: regulatory acceptance, institutional bridges, secure financial primitives, and a clear scaling roadmap.

We’ve moved from proving potential to proving impact. And when that happens in technology, it usually marks the start of a new era, not the end of a hype cycle.